-

Matrixator Review 2024: Revolutionizing Crypto Trading with Advanced Features and Proven Results

•

In the fast-paced world of cryptocurrency trading, having access to a reliable and feature-rich platform is essential for success. Our team has extensively researched and tested various trading platforms, and Matrixator stands out as a top choice for traders of all skill levels. In this comprehensive review, we’ll dive deep into the features, user…

-

Innovative Applications of Blockchain Beyond Cryptocurrency

•

The first thing that typically springs to mind when most people hear “blockchain” is frequently bitcoin. But blockchain technology has far more potential uses than merely for money transfers. A wide range of sectors are looking at the creative benefits of blockchain to boost security and operational efficiency. This post examines some of the…

-

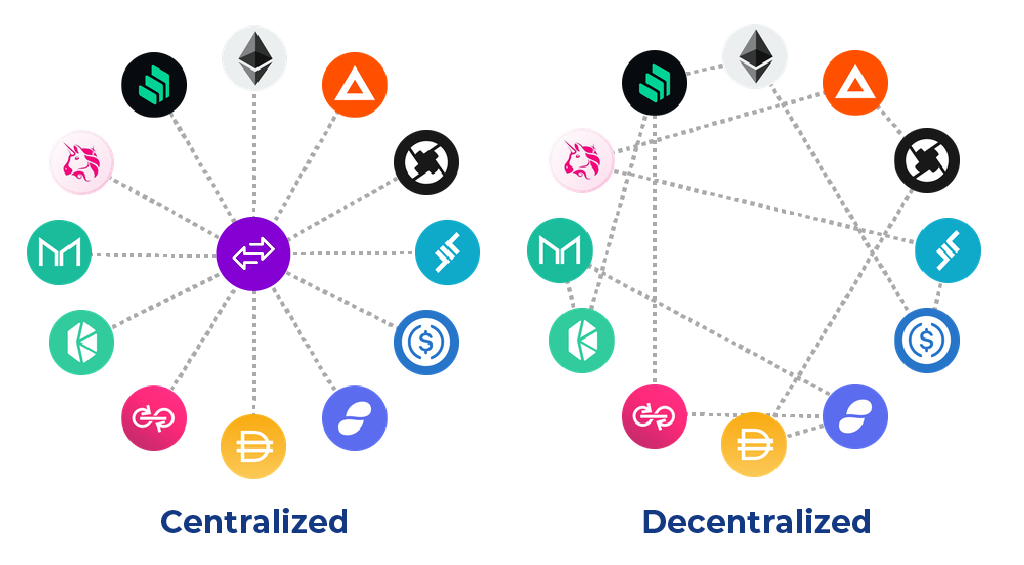

Pros and Cons of Decentralized Exchanges

•

As an alternative to centralised exchanges (CEXs), decentralised exchanges (DEXs) have evolved. While DEXs are open-source platforms that use blockchain technology to support peer-to-peer (P2P) transactions, CEXs are managed by a single firm that handles user accounts and transaction processing and provides the trading platform. Here, we look at DEXs’ benefits and drawbacks. Decentralised…

-

Building a Strong Crypto Community: Strategies for Success

•

Building a Strong Crypto Community: Strategies for Success The landscape of cryptocurrencies is continuously changing, and the strength of their communities greatly influences the viability of crypto projects. A strong crypto community can promote community among its users, speed up adoption, and improve knowledge sharing. This post looks at tactics for creating a robust crypto…

Bitcoin(BTC)$117,777.00-1.57%

Ethereum(ETH)$3,533.490.48%

XRP(XRP)$3.38-4.20%

Tether(USDT)$1.000.00%

BNB(BNB)$725.440.26%

Solana(SOL)$176.08-0.07%

USDC(USDC)$1.000.00%

Dogecoin(DOGE)$0.2338476.85%

Lido Staked Ether(STETH)$3,527.070.56%

Lido Staked Ether(STETH)$3,527.070.56%TRON(TRX)$0.3246172.62%