As an alternative to centralised exchanges (CEXs), decentralised exchanges (DEXs) have evolved. While DEXs are open-source platforms that use blockchain technology to support peer-to-peer (P2P) transactions, CEXs are managed by a single firm that handles user accounts and transaction processing and provides the trading platform. Here, we look at DEXs’ benefits and drawbacks.

Decentralised Exchanges’ Benefits

Improved Transparency

Decentralised exchanges give more transparency, which is one of their many advantages. All transactions are documented on a public blockchain, which offers openness and immutability. This contrasts with centralised exchanges, where data is controlled and handled by a single company and are privately managed.

Improved User Control

DEXs allow the self-custody of cryptocurrencies, giving consumers more control over their holdings. Users hold their private keys and are in charge of their assets on a DEX. Furthermore, DEXs are more secure because there is no single point of failure because they are created as decentralised apps (dApps).

Enhanced Privacy

Since DEXs do not require personal information for trading, they also protect the privacy of user transactions and data. This implies that consumers can start trading bitcoins without providing information about their identity or passport. In contrast, users of CEXs must first confirm their identities to adhere to KYC and AML rules.

Decentralised Exchanges’ Limitations

Liquidity Problems

Since decentralised exchanges have fewer customers and trading activities than centralised exchanges, they currently need liquidity problems. As a result, traders using DEXs may face restrictions since they might need access to the liquidity and volume they need to complete deals swiftly.

Deficiencies in security

DEXs are more vulnerable to hackers and attacks that compromise the platform’s integrity due to their decentralised nature. The technological procedures employed to build the exchange may limit its ability to scale and provide liquidity, posing a security concern.

Issues with Regulatory Compliance

Expanding trading functionality on DEXs is challenging due to regulatory compliance difficulties, particularly in some jurisdictions. Decentralised exchanges are prohibited in several nations because they are unregulated and straightforward to use anonymously.

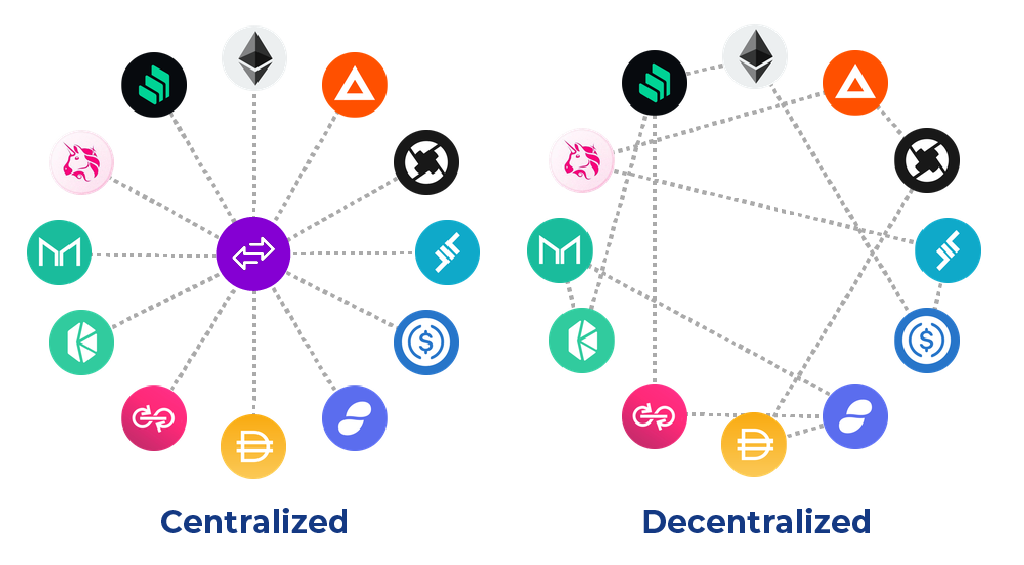

Exchanges: Decentralisation vs. Centralization

Removing the intermediaries that control CEXs, such as banks and other third parties, is one of the critical distinctions and benefits of DEXs. Users and the decentralised platform can now trade. Contrarily, CEXs are susceptible to intrusion from outside parties with variable degrees of security and transparency.

Decentralised Exchanges in the Future

Decentralised exchanges have a bright future. The use of DEXs is likely to increase as decentralised blockchain technologies gain more traction. DEXs are constantly improving and adding new features to meet pressing problems. Cross-chain trading, which enables users to trade cryptocurrencies that function on various blockchain networks, is one such example.

Conclusion

Decentralised exchanges have unique advantages, including improved user control, transparency, and complete security. However, they are also constrained by problems with liquidity, regulatory compliance, and security flaws. However, because DEXs offer free access to available markets and self-custody of users’ digital assets, they remain a vital tool for traders. It will be interesting to watch how DEXs develop and influence the cryptocurrency market’s future in light of the growing popularity and evolution of decentralised exchanges.

1 BTC =

1 BTC =

98626.9400 USD

98626.9400 USD

29.3300000 ETH

29.3300000 ETH

98620.2600 USDC

98620.2600 USDC

63845.1700 XRP

63845.1700 XRP

94238.2900 EUR

94238.2900 EUR

137948.0000 CAD

137948.0000 CAD

151136.5700 AUD

151136.5700 AUD